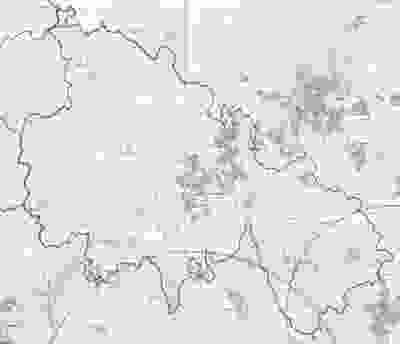

Membership

Common Bond

All Credit Unions have a common bond – something which unites its members. Here at Portadown Credit Union our common bond is that our members must live or work in the Portadown area or surrounding townlands. Our common bond consists of the immediate Portadown area and the following town lands:

- Aghanergill or Corglass, Annaboe, Annagh, Annaghmore, Annagora, Annahugh, Annakeera, Ardress East, Ardress West, Artabrackagh

- Bakkymakeown, Ballintaggart, Ballydonaghy, Ballydugan, Ballyfodrin, Ballygargan, Ballyhagan, Ballyhannon, Ballyleny, Ballylough, Ballylum, Ballymacanallen, Ballymacrandal, Ballymagerny, Ballynagarrick, Ballynaghy, Ballynagow, Ballynarry, Ballyoran, Ballytrue, Ballytyrone, Ballywilly, Ballyworkan, Bleary, Bocombra, Bottlehill, Brackagh, Breagh, Brughas

- Cannagola Beg, Cannagola More, Canoneill, Carn, Carrick, Castleraw, Clare, Clonakale, Cloncarrish, Cloncore, Clonmacash, Clonmakate, Clonmartin, Clonroot, Clontylew, Clownagh, Coharra, Coose, Coragh, Corbracky, Corcrain, Corcullentragh Beg, Corcullentragh More, Cornalack, Cornamucklagh, Cornascreeb, Cranagill, Creenagh, Crewcat, Cushenny

- Derrinraw, Derryall, Derryanvil, Derryaugh, Derrybrughas, Derrycaw, Derrycory, Derrycrew, Derryhale, Derrykeevan, Derrykerran, Derrylard, Derrylettif, Derrylilleagh, Derryloughan, Derrymacfall, Derrymattry, Derryneskan, Derryvane, Derryvore, Diviny, Dressogagh, Drumalis, Drumannon, Drumanphy, Drumaran, Drumard (Jones) (Detached Portion), Drumard (Jones) (Main Portion), Drumard (Primate), Drumcree, Drumgoose, Drumharrif, Drumharriff, Drumhorc, Druminallyduff, Drumlellum, Drumlisnagrilly, Drummenagh, Drummiller, Drumnacanvy, Drumnagoon, Drumnakelly, Drumnascamph, Drumnasoo

- Edenderry, Eglish

- Farra, Fernagreevagh, Foy Beg, Foy More

- Gallrock, Garvaghy, Grange Lower, Grange Upper

- Hacknahay (Main Portion and Detached Portion)

- Kernan, Kilcon, Killycomain, Kilmacanty, Kilmagamish, Kilmore, Kilmoriarty, Kingarve, Knock, Knockmenagh, Knocknagore, Knocknamuckley

- Leganny, Lenaderg, Levaghery, Levalleglish, Lisamintry, Lisavague, Lisnafiffy (Seapatrick), Lisnafiffy (Tullylish), Lisneany, Lisnisky, Lissheffield, Loughans, Loughgall, Lurgancot, Lylo

- Magaraty, Maghery, Maghon, Money, Moyallan, Muckery, Mullabrack, Mulladry, Mullaletragh, Mullantine, Mullavilly

- Richhill or Legacorry, Richmount or Aghavellan, Roughan

- Seagoe Lower, Seagoe Upper, Selshion

- Tamnaficarbet, Tamnafilglassan, Tarsan, Tarthlogue, Tavanagh, Teagy, Timakeel, Timulkenny, Tullylish, Tullymore, Tullyrain

- Unshinagh

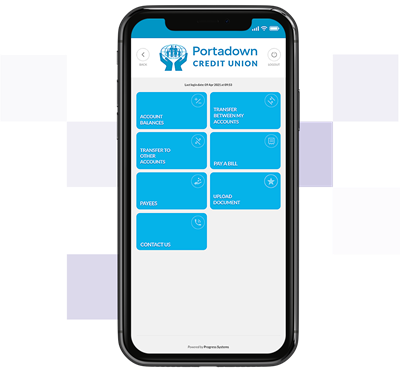

Join Using Your Phone

We’ve created an intelligent and secure method for you to become a member directly through your mobile phone. All you have to do is download our Mobile App to take full advantage of joining as you go.

Secure Facial Verification

We use advanced biometric facial technology to capture and verify who you are. Simply take a quick selfie and you’re done. This intuitive technology, ensures becoming a member is quicker than ever.

Reliable Identity Check

We’ve created a way for you to share proof of ID with us that’s both secure and reliable. As you progress with your application, you will be given an opportunity to show your ID there and then. There’s no waiting around.

All adult members must pay a £1 affiliation fee annually and hold £10 savings in their account at all times. Once a new account has been created, a deposit of at least £11 must be made within 2 days, this can be done in the following ways:

- Over the phone - You can make debit card payments over the phone by calling the office on (028) 38335104

- In person at Portadown Credit Union- 26 Market Street, Portadown

Deposits can be made by cash, cheque or debit payment

If you are a parent/guardian, you can open a minor saving account for the child, if they’re under the age of 16.

In order to open this account, you will need:

- Child’s long birth certificate

- Valid photographic ID of the individual opening the account e.g. passport or driving license

- Proof of address (physical proof dated within the past 3 months e.g. utility bill)

Minor accounts can only be open in office and they will mature into adult accounts when the child reaches the age of 16. At this time, the 16 year old will have sole access to the account and the money held in it.