Loans

Need a Loan? We're here to help!

Portadown Credit Union offer a loan facility to all their members, aged 18 and over. We issue loans up to £60,000 to cater to our member’s needs.

Our loans differ from others in a number of ways:

We calculate your interest on a reducing loan balance

As you pay your loan off, the amount of interest you’re paying back also reduces. This makes your loan cheaper, even though on paper the APR rate may appear higher.

We don’t charge arrangement fees

While other financial organisations charge fees for the setting up of loans, we don’t. Portadown Credit Union exists to provide a service to you, not to profit from you.

We don’t penalise you if you want to pay your loan off early

Whilst other financial organisations charge you extra if you want to increase your payments and settle your loan early – we don’t. We know it’s in your best interest to pay your loan off as quickly as you can as this reduces the amount of interest you pay.

We offer free life insurance on loans

To give you peace of mind we fully insure your loan in the event of your death and at no cost to you, up to your 85th birthday (subject to terms and conditions). This contrasts with banks and building societies who charge their customers hefty sums to offer exactly the same facility.

Try out our quick and easy loan calculator below

Maximum Loan Term :

6%

6%

This calculator is for illustrative purposes only, to give you, the borrower, an overview of the potential cost of borrowing. The Credit Union, or any of its staff, cannot be held responsible for any errors. Please note that this calculator only provides an indicative quote and actual repayments may vary.

Secured vs Unsecured loans

Secured Loan

A secured loan is borrowing up to 90% of your shares. These loans do not require an appointment and can be processed at the counter. A maximum of £500 cash can be issued and the remaining via cheque or bank transfer. Guarantor's are not needed for secured loans.

Unsecured Loan

An unsecured loan is NOT based on the savings held in your PCU account. You must be able to demonstrate affordability for the repayments by providing three months bank statements across all accounts held. In most instances, guarantor's will be required for a first time unsecured loan. They must be in full-time employment and over the age of 21. They will also be required to provide three months bank statements.

PCU's APRs Explained

Secured Loans 6% APR

Our most competitive rate at the moment is our new 6% APR for secured loans. A SECURED loan IS based on your savings held in your PCU account. You can avail of this cheaper APR by borrowing up to 90% of your savings. This money is held as collateral against your savings until your loan is paid off e.g. you will not be able to withdraw the amount of money you have out as a loan. Any money over this loan amount or saved after the loan was issued is accessible. Our current maximum saving cap is £15,000 per member, in this instance, the member would be able to borrow £13,500 at 6% APR.

Secured loans do not require bank statements or a loan appointment. A maximum of £500 cash can be issued over the counter and the remaining via cheque or bank transfer.

8% APR for Loans £10,000+

Our 8% APR for loans £10,000+ is a great option for those members who don't have £10,000 in their savings therefore can't avail of a secured loan position. This is considered an UNSECURED loan and IS NOT based on your savings. The minimum loan value for this rate is £10,000 to the maximum loan value of £60,000.

This loan can be applied for online or by scheduling a loan appointment in office. Applicants will need to provide 3 months bank statements across all accounts held. At times, a guarantor may be needed. This 8% APR Loan can be topped up with a minimum top up value of £10,000.

Standard 12.68% APR Loan

All UNSECURED loans under £10,000 will be charged 12.68% APR.

This loan can be applied for online or by scheduling a loan appointment in office. Applicants will need to provide 3 months bank statements across all accounts held. At times, a guarantor may be needed.

A breakdown of how your PCU loan is paid

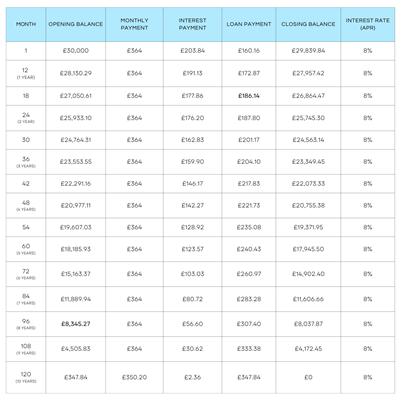

Below is an example of how a Portadown Credit Union loan is paid off. This example is for a £30,000 loan over 10 years on our lower 8% APR (for loans £10,000-£60,000).

Interest is calculated on the balance of the loan; as the closing balance reduces so does the interest.

Ready to Apply?

Are you ready to apply or do you need more information on our affordable loans? Click on "Apply Now" button to start your journey right now. Click on "Contact Us" button to send us a message or call to the Office and talk to our friendly staff.

Other Info

Never be afraid to apply for a loan; as your local lender we want to lend to as many people as possible. However, the most important factor for us when we are assessing your application is to make sure that you can afford the loan. We do this to protect you and to protect our other members, as after all, it is their money that you are borrowing. The majority of loan applications can be approved by our fully trained loan officers and you will receive an immediate decision.

Although, if it is your first loan, for a large sum of money or there are concerns about how the account is being maintained, then the application will be referred to the Credit Committee.

Please note, members will need to provide 3 months bank statements for loans that are not secured. Online loan applications will take longer to approve. We ask that those attending in office loan appointments have their 3 months bank statements printed or emailed to info@portadowncu.com prior to the appointment.

For first time borrowers and for certain loans, the Credit Committee may make the decision to only grant the loan, if a suitable guarantor can be assigned to the loan; this can be a family member or friend. They do not need to be a member of Portadown Credit Union however need to be aged 21+ and in full time employment.

The Credit Committee is comprised of a group of people including volunteers, management and board members, who meet every Thursday morning to adjudicate on loans; each of these individuals have many years of Credit Union experience.

If someone has asked you to act as a guarantor for them, please make sure you fully understand the commitment you are making.

Effectively, you are signing a legal document to say that if the individual defaults on their loan, you are willing to take responsibility for it. Consider long and hard as to whether you know this person will keep up repayments, even if their circumstances change.

Proposed guarantors have to complete a Guarantor Form which requires the disclosure of financial information. The proposed guarantor will also have to agree to be credit searched. Only when the proposed guarantor returns the Guarantor Form and Credit Committee has approved them, can the loan be paid out.

Guarantors should be aware that they have to provide proof of their income (3 months bank statements) and consent to a Credit Search before they can be approved as being a suitable guarantor.

Whenever you take a loan you sign a promissory note (a legally binding document) agreeing to pay off your loan within a specified period of time. We always recommend that member’s complete their loan as quickly as possible in order to minimise the amount of interest they pay.

We understand that circumstances can change that are out of your control, therefore, if something happens that affects your ability to meet your agreed repayments, it is crucial that you contact us to talk about your situation therefore we can work out a plan of action.

It is important to remember, that not paying your loan as agreed can impact negatively on your credit record.

If you would like to contact us about a change of circumstance, please call us on: (028) 3833 5104.